The balance sheet represents a snapshot of a company’s financial position, and within it, net assets calculation emerges as a crucial metric. This calculation is vitally important for understanding a company’s true financial health. Accountants use net assets calculation in many business operations to determine solvency and stability. Generally Accepted Accounting Principles (GAAP) provide the standardized rules and guidelines for net assets calculation across different sectors. The interpretation of net assets calculation data can be used in making decisions related to investment and financial risk management.

Net Assets Calculation: The Ultimate Simple Guide – Article Layout

This guide outlines the best article layout for explaining "Net Assets Calculation," ensuring the content is clear, easy to understand, and optimized for search engines. The primary focus is on simplifying the concept while maintaining accuracy.

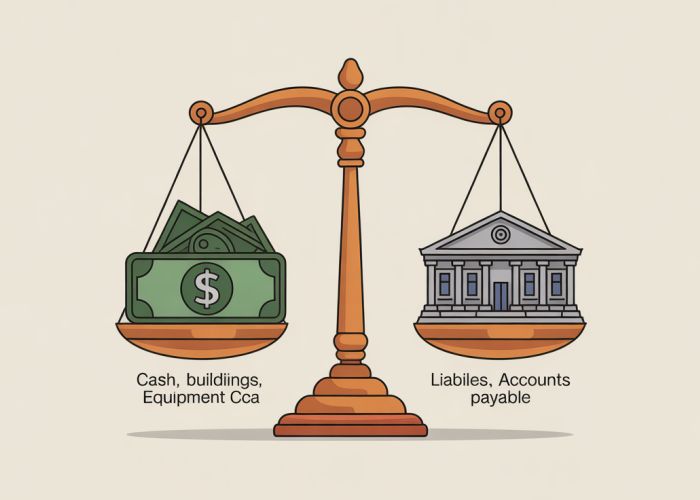

Understanding Net Assets: The Foundation

This section should introduce the core concept of net assets and why it’s important.

- What are Assets? Briefly explain what assets are in a business context (things a company owns that have value). Give examples:

- Cash

- Accounts Receivable

- Inventory

- Equipment

- Real Estate

- What are Liabilities? Explain liabilities (what a company owes to others). Give examples:

- Accounts Payable

- Loans

- Salaries Payable

- Deferred Revenue

- Defining Net Assets: Clearly define net assets as the difference between total assets and total liabilities. Use a simple equation:

- Net Assets = Total Assets – Total Liabilities

- Why Net Assets Matter: Explain the significance of net assets.

- Indicates a company’s financial health.

- Used by investors to assess value.

- Helps with internal financial planning.

Step-by-Step Net Assets Calculation

This section provides a practical, step-by-step guide to calculating net assets.

-

Gather Financial Data: Explain where to find the necessary information.

- Balance Sheet (most important)

- Accounting Software Reports

-

Calculate Total Assets: Detail how to sum up all assets.

- List each asset category (as mentioned above in "What are Assets?")

- Provide an example: If Cash = $10,000, Accounts Receivable = $5,000, and Inventory = $2,000, then Total Assets = $17,000.

-

Calculate Total Liabilities: Detail how to sum up all liabilities.

- List each liability category (as mentioned above in "What are Liabilities?")

- Provide an example: If Accounts Payable = $3,000 and Loans = $1,000, then Total Liabilities = $4,000.

-

Apply the Formula: Subtract total liabilities from total assets.

- Net Assets = Total Assets – Total Liabilities

- Using the previous examples: Net Assets = $17,000 – $4,000 = $13,000.

Example Calculation

Present a complete example to solidify understanding.

Scenario: Small Business "ABC Co."

Present a mini-balance sheet for "ABC Co." using a table format.

| Asset | Amount | Liability | Amount |

|---|---|---|---|

| Cash | $20,000 | Accounts Payable | $8,000 |

| Accounts Receivable | $10,000 | Short-term Loan | $5,000 |

| Inventory | $5,000 | ||

| Equipment | $15,000 | ||

| Total Assets | $50,000 | Total Liabilities | $13,000 |

Calculation

- Total Assets = $50,000

- Total Liabilities = $13,000

- Net Assets = $50,000 – $13,000 = $37,000

Interpretation

Explain what the $37,000 figure means in the context of ABC Co.

Variations and Considerations

This section addresses potential complexities and nuances.

- Intangible Assets: Briefly discuss intangible assets (patents, trademarks, goodwill) and their role in net assets calculation.

- Depreciation: Explain how depreciation affects the value of fixed assets (e.g., equipment) and, consequently, net assets.

- Equity: Explain the relationship between Net Assets and Equity. In many cases they are the same, however in corporations where contributed capital is tracked separately, Equity = Net Assets + Contributed Capital.

- Personal Net Worth: Briefly explain how net asset calculation principles apply to personal finance (assets like savings, investments, and property minus liabilities like mortgages and loans).

- Non-Profits: Briefly explain the equivalent of "Net Assets" within non-profits and charities is referred to as "Net Funds" or "Funds"

Frequently Asked Questions About Net Assets Calculation

Got more questions about calculating your net assets? Here are some common questions and quick answers.

What exactly are considered "assets" when calculating net assets?

Assets include anything of value you own, such as cash, investments (stocks, bonds, mutual funds), real estate, personal property (cars, furniture), and accounts receivable. Remember to use the current market value for these assets when performing your net assets calculation.

What types of liabilities are subtracted to find net assets?

Liabilities are your debts or obligations. Common liabilities include loans (mortgages, car loans, student loans), credit card debt, medical bills, and unpaid taxes. These debts are subtracted from your total assets in the net assets calculation.

Is net assets calculation only for individuals?

No. While individuals often use it for personal finance, businesses and organizations also calculate net assets (often called "equity" or "net worth"). The principle remains the same: assets minus liabilities. The specific asset and liability categories differ depending on the entity.

What does a negative net assets value signify?

A negative net assets value indicates that your liabilities (debts) exceed your assets. This suggests financial vulnerability and a need to focus on debt reduction or asset growth. Understanding this through net assets calculation is the first step towards improvement.

Alright, you’ve got the lowdown on net assets calculation! Now go out there and put that knowledge to good use. Good luck!