Long-Run Aggregate Supply (LRAS), a crucial concept explored within Macroeconomics, represents the potential output an economy can produce at full employment. Technological advancements, a key determinant of LRAS, directly influence the economy’s productive capacity. Simultaneously, the labor force participation rate dictates the available workforce, significantly affecting the determinants of lras. Finally, focusing on the policies advocated by institutions like the International Monetary Fund (IMF) allows us to identify that its structure supports understanding influences on LRAS shifts, revealing further implications for sustainable economic progression.

The Long-Run Aggregate Supply (LRAS) curve represents the total quantity of goods and services an economy can produce when all its resources are fully employed. Understanding LRAS is crucial because it defines the potential for sustained economic growth, indicating the economy’s capacity to expand without triggering inflation. It’s not merely a theoretical construct; it’s the bedrock upon which long-term economic planning and policy are built.

Defining Long-Run Aggregate Supply (LRAS)

LRAS is visualized as a vertical line on a graph with price level on the Y-axis and real GDP on the X-axis. Its vertical nature signifies that in the long run, output is determined by the economy’s productive capacity, independent of the price level. Factors such as technology, capital stock, and the size and skill of the labor force dictate this capacity.

A rightward shift of the LRAS curve signifies economic growth, indicating the economy can produce more goods and services at any given price level. This shift is the ultimate goal of many economic policies, as it translates to higher living standards and greater overall prosperity.

The Significance of LRAS for Sustained Economic Growth

The importance of LRAS lies in its ability to illustrate the sustainable growth potential of an economy. Short-term fluctuations in aggregate demand can cause temporary booms, but these are unsustainable if they exceed the economy’s long-run capacity. Policies aimed at shifting the LRAS curve to the right are therefore paramount for achieving lasting economic progress.

Consider investments in education and infrastructure. These investments don’t just offer immediate boosts; they fundamentally enhance the economy’s ability to produce in the long run. Such improvements are reflected in a rightward shift of the LRAS, paving the way for sustained, non-inflationary growth.

Determinants of LRAS and their Importance for Policy-Making

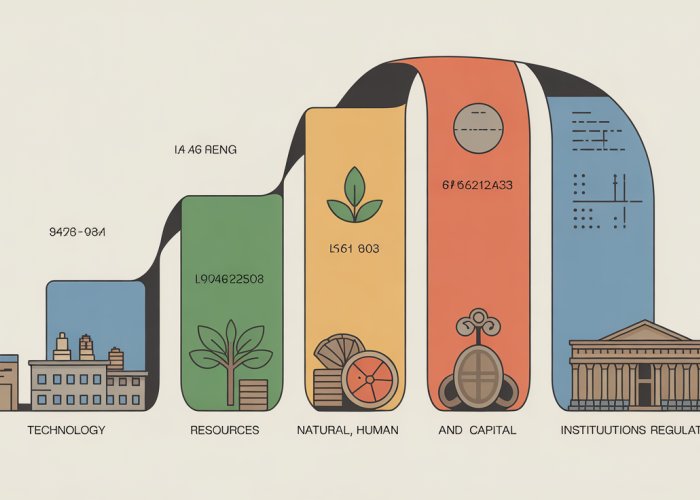

Effective policy-making relies on a deep understanding of the factors that determine LRAS. These determinants include:

- Technology: Technological advancements enhance productivity and efficiency.

- Capital Stock: The availability of physical capital (machinery, equipment, infrastructure) directly impacts production capacity.

- Human Capital: The skills, knowledge, and health of the workforce are critical for productivity.

- Natural Resources: Access to and efficient use of natural resources can influence LRAS, although this is often less critical in developed economies.

- Institutional Framework: Property rights, rule of law, and the efficiency of government regulations also play a significant role.

By understanding how these factors influence LRAS, policymakers can craft targeted interventions to foster long-term growth. Policies promoting research and development, education reforms, infrastructure investments, and regulatory improvements can all contribute to a more productive and resilient economy. Failing to consider these determinants can lead to policies that provide only short-term gains, while doing little to expand the economy’s underlying productive capacity.

Potential Output: The Economy at Full Stretch

Closely linked to LRAS is the concept of potential output. This represents the level of output an economy can achieve when all its resources—labor, capital, and technology—are fully employed. It’s the output level where there is no cyclical unemployment, and resources are being used efficiently. Potential output is not a static number; it grows as the LRAS curve shifts to the right.

Understanding potential output is crucial for macroeconomic stability. When actual output falls below potential output, it signals an underutilization of resources and the need for policies to stimulate demand. Conversely, when actual output exceeds potential output, it can lead to inflationary pressures, necessitating policies to cool down the economy. By monitoring and managing the gap between actual and potential output, policymakers can strive for sustainable, balanced economic growth.

Consider investments in education and infrastructure. These investments don’t just create jobs in the short term; they enhance the overall productive capacity of the economy, allowing it to produce more goods and services in the long run. But what specifically fuels this engine of growth? Let’s dive into the powerful role productivity plays in shifting the LRAS curve and driving long-term economic prosperity.

The Power of Productivity: Engine of Long-Term Growth

Productivity is the cornerstone of sustained economic growth. When an economy becomes more productive, it can produce more goods and services with the same amount of resources.

This increased output directly translates to a rightward shift of the Long-Run Aggregate Supply (LRAS) curve, indicating a greater potential output at any given price level.

In essence, productivity improvements unlock an economy’s ability to grow without necessarily triggering inflation. This ability is a key indicator of an economy’s long-term strength.

How Productivity Shifts the LRAS Curve

The LRAS curve represents the economy’s potential output when all resources are fully employed. Productivity gains effectively expand this potential.

Think of it like this: if workers become more skilled through training (a productivity improvement), they can produce more goods or services in the same amount of time.

This increased efficiency raises the overall productive capacity of the economy, shifting the LRAS curve to the right. This increase signals that sustainable economic growth is truly possible.

This shift allows for higher standards of living and greater overall economic prosperity without necessarily causing upward pressure on prices.

Drivers of Productivity Gains

Several factors contribute to productivity improvements. Identifying and fostering these factors is critical for policymakers aiming to boost long-term growth.

-

Innovation: Technological breakthroughs, new business models, and creative problem-solving drive significant productivity gains. Innovation allows us to do more with less and create entirely new products and industries.

-

Efficiency Improvements: Streamlining processes, reducing waste, and optimizing resource allocation can lead to substantial productivity improvements. Efficient operations translate to lower costs and higher output.

-

Resource Allocation: Directing resources to their most productive uses is essential. This includes allocating capital to promising industries, encouraging labor mobility, and fostering competition to weed out inefficient firms.

Real-World Examples of Productivity-Driven Growth

Many countries have successfully leveraged productivity improvements to achieve remarkable economic growth.

-

South Korea: In the latter half of the 20th century, South Korea transformed itself from an agrarian society to a high-tech powerhouse through strategic investments in education, technology, and infrastructure.

This example reflects how a focused approach can pay off handsomely, transforming the economy from a developing nation to one that is highly developed and technically advanced.

-

Ireland: Ireland’s economic boom in the late 1990s and early 2000s was fueled by foreign direct investment, a skilled workforce, and a favorable regulatory environment. These improvements attracted multinational corporations and spurred innovation.

This led to significant productivity gains, and in turn, rapid economic expansion and higher living standards.

-

Singapore: This city-state has consistently focused on education, infrastructure, and technological innovation. This focus allowed Singapore to become a global hub for finance, trade, and technology.

The sustained productivity gains demonstrate the power of long-term strategic planning and investment. This planning can create an environment conducive to economic growth.

By studying these success stories, policymakers can gain valuable insights into the strategies and policies that foster productivity growth and drive long-term economic prosperity.

The increase signals that sustainable economic growth is truly possible. This shift allows for higher standards of living and greater overall economic prosperity without necessarily causing upward pressure on prices. But productivity is not the only force reshaping the economic landscape. Another powerful influence is the relentless advance of technology.

Technological Advancements: Shaping the Production Landscape

Technology is not merely a tool; it’s a catalyst for transformative change, especially within the realm of Long-Run Aggregate Supply (LRAS). It acts as a primary engine, propelling LRAS outward by fundamentally altering how goods and services are produced. Understanding technology’s multifaceted impact is crucial for grasping the dynamics of long-term economic growth.

The Engine of Efficiency and Innovation

Technological innovation is the bedrock upon which productivity gains are built. New technologies often streamline production processes, reduce waste, and enable the creation of entirely new products and services.

Consider the impact of automation in manufacturing. Robots and advanced machinery can perform tasks more quickly and accurately than humans, leading to increased output and lower production costs.

The advent of the internet has also revolutionized industries, fostering e-commerce, digital marketing, and remote collaboration, all of which contribute to enhanced efficiency.

These innovations drive down costs, increase output, and ultimately shift the LRAS curve to the right.

Disruptive Technologies and the Shifting Labor Market

While technology brings immense benefits, it also presents challenges. Disruptive technologies can displace workers in certain industries, requiring adaptation and retraining.

The rise of artificial intelligence (AI) and machine learning, for example, is automating tasks previously performed by humans, leading to concerns about job displacement.

The key is not to resist technological progress but to proactively address its potential negative consequences.

This involves investing in education and training programs to equip workers with the skills needed to thrive in the new economy. It also requires fostering a culture of lifelong learning, where individuals continuously update their skills to remain relevant in a rapidly changing job market.

Solow’s Contribution: Modeling Technological Change

Robert Solow, a Nobel laureate in economics, made significant contributions to our understanding of technological change and its impact on economic growth. His work highlighted the role of technological progress as a key driver of long-term economic expansion, separate from capital accumulation and labor force growth.

Solow’s growth model emphasized the importance of technological advancements in explaining sustained increases in output per capita.

He showed that technological progress could lead to higher standards of living even in the absence of increases in capital or labor inputs. His insights remain relevant today, as we grapple with the challenges and opportunities presented by rapid technological innovation.

The relentless march of technology, while undeniably transformative, casts a long shadow if not coupled with an equally robust investment in human potential. Technology alone cannot unlock the full productive capacity of an economy. It requires a workforce equipped with the skills, knowledge, and health necessary to adapt, innovate, and thrive in a rapidly changing world.

Investing in Human Capital: Building a Skilled Workforce

Human capital, encompassing the skills, knowledge, experience, and health of a workforce, stands as a cornerstone of Long-Run Aggregate Supply (LRAS). It’s not merely about having more people in the labor force, but about the quality of that workforce.

A nation’s capacity to produce goods and services sustainably over the long term hinges significantly on the development and effective utilization of its human capital. Neglecting this crucial element can severely limit an economy’s potential, regardless of technological advancements or natural resource endowments.

Education: The Foundation of Human Capital

Education, from primary schooling to higher learning, is the bedrock upon which human capital is built. A well-educated populace is more adaptable, innovative, and productive.

It’s better equipped to understand and utilize new technologies, solve complex problems, and contribute meaningfully to the economy.

Moreover, education fosters critical thinking, communication skills, and a sense of civic responsibility, all of which are essential for a thriving society.

Investment in education should extend beyond simply increasing enrollment rates. It requires a focus on quality, ensuring that curricula are relevant to the needs of the modern economy, and that teachers are well-trained and supported.

Training: Equipping the Workforce for the Future

While education provides a broad foundation, training equips individuals with the specific skills needed for particular jobs and industries.

In an era of rapid technological change, lifelong learning and skills development are becoming increasingly important.

Governments and businesses must invest in training programs that help workers adapt to new technologies, acquire new skills, and remain competitive in the global marketplace.

This includes apprenticeships, vocational training, and on-the-job training programs that provide practical experience and hands-on learning opportunities.

Healthcare: Ensuring a Healthy and Productive Workforce

A healthy workforce is a productive workforce. Access to quality healthcare is essential for maintaining and improving human capital.

Illness and disability can reduce productivity, absenteeism, and ultimately, economic output.

Investing in preventative care, health education, and affordable healthcare access can significantly improve the health and well-being of the workforce, leading to increased productivity and economic growth.

The Link Between Human Capital Development and Economic Inequality

While investing in human capital is crucial for economic growth, it is equally important to ensure that these investments benefit all members of society.

Disparities in access to education, training, and healthcare can exacerbate economic inequality, creating a cycle of poverty and disadvantage.

Children from low-income families may lack access to quality education, limiting their opportunities for upward mobility. Similarly, lack of access to healthcare can lead to chronic health problems that hinder their ability to work and earn a living.

Addressing these disparities requires targeted policies that provide equal opportunities for all, regardless of their socioeconomic background. This may include scholarships, grants, and other forms of financial assistance to help low-income students access quality education.

It also includes expanding access to affordable healthcare and providing job training programs specifically designed to help disadvantaged workers acquire the skills they need to succeed in the modern economy.

By investing in human capital development and addressing economic inequality, societies can unlock the full potential of their workforce and build a more prosperous and equitable future for all.

The advancements in technology and the investments in human capital are pivotal in shifting the Long-Run Aggregate Supply. However, these factors operate within the boundaries set by our planet. The availability and responsible management of natural resources, coupled with a commitment to environmental sustainability, are equally crucial for sustaining long-term economic growth. Ignoring these aspects can undermine even the most impressive gains in other areas, creating an unsustainable and ultimately detrimental trajectory.

Natural Resources and Sustainable Growth

Natural resources, the raw materials provided by nature, have historically been fundamental to economic activity. From fertile land for agriculture to mineral deposits for manufacturing, these resources form the bedrock of production processes.

However, their role in Long-Run Aggregate Supply (LRAS) is more nuanced than simple availability. It’s about sustainable management and recognizing the environmental limits within which economies must operate.

The Dual Role of Natural Resources

Natural resources contribute to LRAS in two primary ways:

-

Direct Inputs: Resources like oil, gas, minerals, and timber directly fuel production processes. Their abundance can provide a comparative advantage, driving economic growth, as seen in countries with substantial oil reserves.

-

Environmental Foundation: A healthy environment provides essential ecosystem services, such as clean air and water, pollination, and climate regulation. These services are vital for agriculture, tourism, and overall human well-being, indirectly supporting LRAS.

The Impact of Resource Depletion and Pollution

Unsustainable exploitation of natural resources and unchecked pollution can severely hinder long-term economic growth.

-

Resource Depletion: Over-extraction of resources like fossil fuels and minerals leads to scarcity, driving up costs and limiting production capacity. This can create supply bottlenecks, reduce overall output, and undermine the LRAS.

-

Environmental Degradation: Pollution, deforestation, and climate change have far-reaching consequences. They can reduce agricultural productivity, damage infrastructure, increase healthcare costs, and displace populations.

These effects diminish the overall productive capacity of an economy.

Policies for Resource Conservation and Sustainable Development

To ensure long-term prosperity, policies must prioritize resource conservation and sustainable development.

These policies should aim to balance economic growth with environmental protection.

-

Investing in Renewable Energy: Transitioning to renewable energy sources like solar, wind, and hydro power reduces reliance on finite fossil fuels. It mitigates greenhouse gas emissions, and fosters innovation and creates new economic opportunities.

-

Promoting Resource Efficiency: Encouraging businesses and consumers to use resources more efficiently through technological advancements, waste reduction programs, and circular economy models minimizes environmental impact.

-

Implementing Environmental Regulations: Strong environmental regulations, such as pollution controls, emissions standards, and protected areas, are crucial for safeguarding ecosystems and human health. They internalize environmental costs, incentivizing sustainable practices.

-

Valuing Natural Capital: Incorporating the value of ecosystem services into economic decision-making through natural capital accounting helps to better assess the true costs and benefits of economic activities. It prevents the degradation of essential environmental assets.

The Path to Sustainable LRAS

Achieving sustainable LRAS requires a fundamental shift in mindset.

It moves away from a purely extractive economic model towards one that values natural resources and ecosystem services.

It recognizes the long-term benefits of environmental stewardship.

By adopting policies that promote resource conservation, invest in clean technologies, and protect the environment, nations can build resilient and prosperous economies. These can sustain growth for generations to come.

The Role of Institutions

While technology, human capital, and natural resources lay the groundwork for economic production, the quality of a nation’s institutions determines how effectively these resources are utilized. Efficient and equitable political and economic systems act as catalysts, fostering an environment conducive to investment, innovation, and sustained growth. The absence of such institutions, conversely, can stifle progress, regardless of a nation’s inherent advantages.

Defining "Institutions" in an Economic Context

The term "institutions," in this context, encompasses the formal and informal rules, norms, and enforcement mechanisms that govern economic and political interactions within a society. These include:

-

Property Rights: Clear and enforceable property rights are fundamental. They incentivize investment, as individuals and businesses are confident that they will reap the rewards of their efforts.

-

Contract Enforcement: A reliable legal system that enforces contracts is essential for facilitating transactions and fostering trust between economic actors.

-

Rule of Law: The principle that everyone is subject to the law, regardless of their position or power, ensures fairness and predictability in the economic environment.

-

Regulatory Quality: Regulations should be efficient, transparent, and designed to promote competition and protect consumers, without unduly burdening businesses.

-

Political Stability: A stable political environment reduces uncertainty and encourages long-term investment. Frequent political upheaval or corruption can deter investment and hinder economic growth.

How Institutions Drive Economic Growth

Strong institutions contribute to long-run aggregate supply (LRAS) through several key channels:

Fostering Investment

Secure property rights and contract enforcement provide the necessary assurances for individuals and businesses to invest in physical and human capital. When investors are confident that their investments will be protected, they are more willing to take risks and pursue long-term projects that boost productivity.

Encouraging Innovation

A transparent and well-regulated economic environment fosters innovation by creating a level playing field for businesses. It reduces barriers to entry, allowing new firms to compete and challenge established players. This competition drives firms to innovate and improve their products and services, leading to increased productivity and economic growth.

Promoting Efficient Resource Allocation

Efficient institutions ensure that resources are allocated to their most productive uses. For example, a well-functioning financial system channels savings to the most promising investment opportunities. Similarly, open and competitive markets allow prices to reflect true costs and benefits, guiding resources to where they are most needed.

Reducing Corruption

Corruption distorts resource allocation, undermines the rule of law, and discourages investment. Strong institutions, such as independent judiciaries and transparent government agencies, can help to curb corruption and promote good governance. This creates a more level playing field for businesses and fosters trust in the economic system.

The Interplay of Political and Economic Institutions

It’s important to recognize that political and economic institutions are closely intertwined. A stable and democratic political system is more likely to produce sound economic policies and protect property rights. Conversely, a corrupt or authoritarian regime is likely to undermine economic institutions and hinder growth.

In conclusion, efficient and equitable institutions are crucial for realizing a nation’s full economic potential. By fostering investment, encouraging innovation, promoting efficient resource allocation, and reducing corruption, strong institutions shift the LRAS curve to the right, leading to sustained economic growth and improved living standards. Understanding and strengthening these institutions is therefore paramount for policymakers seeking to create a more prosperous future.

The Importance of Full Employment and the LRAS

Now that we have examined the institutional factors that shape long-run aggregate supply, it’s vital to connect those supply-side considerations to the labor market. Understanding how the LRAS is inherently linked to full employment allows us to see how policy interventions can play a crucial role in shaping an economy’s potential output.

LRAS as a Reflection of Full Employment

The Long-Run Aggregate Supply (LRAS) curve, at its core, signifies the potential output an economy can sustainably produce.

This level of output isn’t some arbitrary point; it’s specifically tied to the concept of full employment.

Full employment doesn’t mean that everyone has a job. Rather, it represents a situation where the economy is using all its available resources efficiently, including its labor force.

There will always be some level of unemployment due to frictional (people moving between jobs) and structural (mismatch of skills) factors.

However, at full employment, cyclical unemployment (unemployment due to downturns in the business cycle) is essentially zero.

Therefore, the LRAS curve illustrates the quantity of goods and services the economy can produce when unemployment is at its natural rate.

An economy operating on its LRAS is operating at its production possibility frontier.

Government Policy and the Pursuit of Full Employment

Governments have several tools at their disposal to influence the level of employment and, by extension, economic output.

These policies can be broadly categorized as either supply-side or demand-side, though their effects often intertwine.

Supply-Side Policies

Supply-side policies aim to increase the economy’s productive capacity.

These policies, as detailed earlier, include investments in education and training programs to boost human capital.

Also included is infrastructure development to improve efficiency and reduce costs for businesses.

Tax incentives and deregulation can also encourage investment and innovation, all contributing to a rightward shift in the LRAS curve.

By improving the quality and quantity of labor, supply-side policies reduce structural unemployment and move the economy closer to its full employment potential.

Demand-Side Policies

Demand-side policies, on the other hand, focus on stimulating aggregate demand (AD) in the economy.

These policies primarily encompass fiscal policy (government spending and taxation) and monetary policy (interest rates and money supply).

During periods of recession or economic slowdown, governments can increase spending or cut taxes to boost demand.

Central banks can lower interest rates to encourage borrowing and investment.

While demand-side policies cannot shift the LRAS curve directly, they can help ensure the economy operates closer to its potential output by minimizing cyclical unemployment.

The goal is to bring the economy’s actual output in line with its potential, as defined by the LRAS.

The Interplay of Supply and Demand

It is important to understand that supply and demand-side policies are not mutually exclusive.

In fact, they often work best when implemented in a coordinated manner.

For instance, investing in education (supply-side) may not have its full impact if there isn’t sufficient demand for skilled labor in the economy (demand-side).

Similarly, stimulating demand without addressing underlying supply constraints can lead to inflation without a sustained increase in output.

Therefore, effective policy-making requires a holistic approach that considers both the supply and demand sides of the economy to achieve full employment and maximize long-run economic output.

Case Studies: Examining LRAS Determinants in Action

Understanding the theoretical underpinnings of Long-Run Aggregate Supply (LRAS) is crucial, but observing its drivers in real-world scenarios provides invaluable insights. By examining specific countries and regions, we can dissect the practical impact of various policies and investments on long-term economic growth. This section delves into several case studies, drawing upon data from the World Bank and International Monetary Fund (IMF) to illustrate both successes and failures in the pursuit of enhanced LRAS.

Ireland: A Story of Human Capital Investment

Ireland offers a compelling example of how strategic investment in human capital can dramatically shift the LRAS curve.

In the late 20th century, Ireland transformed itself from an agrarian economy to a high-tech hub.

A cornerstone of this transformation was a concerted effort to improve education at all levels.

The Irish government invested heavily in universities and technical colleges, attracting foreign direct investment (FDI) in sectors like pharmaceuticals and technology.

This influx of investment, coupled with a highly skilled workforce, propelled Ireland’s productivity and potential output.

IMF data reveals that Ireland’s GDP per capita experienced substantial growth during this period, directly attributable to these strategic investments.

However, the Irish experience also underscores the importance of sustainable growth.

The rapid expansion led to imbalances and vulnerabilities, highlighting the need for diversified growth strategies.

China: The Manufacturing Juggernaut and Technological Leap

China’s economic ascent is arguably the most significant economic story of the past few decades.

A key driver has been its ability to leverage manufacturing productivity on an unprecedented scale.

Initially, this growth was fueled by low labor costs and the adoption of existing technologies.

However, China has increasingly focused on technological innovation, with massive investments in research and development (R&D).

This shift is evident in the rise of Chinese tech giants and their increasing competitiveness in global markets.

World Bank statistics demonstrate China’s remarkable rise in R&D spending as a percentage of GDP.

This strategic focus on technological advancement has allowed China to not only increase its output but also to move up the value chain.

China’s experience also provides a cautionary tale regarding environmental sustainability.

Rapid industrialization has come at a significant environmental cost, underscoring the importance of balancing economic growth with ecological concerns.

Sub-Saharan Africa: Navigating Natural Resources and Institutional Challenges

Many countries in Sub-Saharan Africa are rich in natural resources, yet their economic performance often lags behind other regions.

This paradox highlights the importance of institutions and governance in translating resource wealth into sustainable growth.

Countries with strong property rights, transparent legal systems, and effective regulatory frameworks tend to fare better in utilizing their natural resources for long-term economic development.

Conversely, countries plagued by corruption, political instability, and weak institutions often struggle to harness their resource wealth effectively.

The experiences of Botswana, which has managed its diamond wealth relatively effectively, stand in contrast to those of countries where resource revenues have been mismanaged or diverted.

The African continent also highlights the importance of diversification.

Over-reliance on a single commodity makes economies vulnerable to price shocks and can hinder the development of other sectors.

Lessons Learned: A Synthesis of Successes and Failures

These case studies underscore the multifaceted nature of LRAS and the importance of a holistic approach to economic development.

No single factor guarantees success; rather, a combination of strategic investments, sound policies, and strong institutions is essential.

Investing in human capital, fostering technological innovation, promoting sustainable resource management, and building robust institutions are all critical ingredients for sustained economic growth.

Furthermore, these case studies highlight the importance of adaptability and resilience.

Economies must be able to adapt to changing global circumstances and overcome unexpected challenges.

By learning from both successes and failures, policymakers can chart a course toward a more prosperous and sustainable future.

Policy Implications: Strategies for Boosting LRAS

Having explored the diverse factors that influence Long-Run Aggregate Supply (LRAS), it’s crucial to translate this understanding into actionable policies. Governments and businesses alike have a vital role to play in fostering an environment conducive to sustained economic growth. Strategic interventions, particularly in key areas like education, infrastructure, and innovation, can significantly shift the LRAS curve outwards, unlocking a nation’s potential output.

Investing in the Foundations of Growth

Sustained economic expansion hinges on laying a solid foundation. This entails prioritizing investments in areas that directly enhance productivity and efficiency.

The Indispensable Role of Education

Education is arguably the cornerstone of long-term economic prosperity. A well-educated populace is more adaptable, innovative, and productive.

Governments should prioritize funding for all levels of education, from primary schools to universities. Moreover, curricula must evolve to meet the demands of a rapidly changing global economy, with a focus on STEM fields (Science, Technology, Engineering, and Mathematics).

Infrastructure: The Backbone of Economic Activity

Reliable infrastructure is essential for facilitating trade, commerce, and overall economic activity. Investments in transportation networks (roads, railways, ports), energy grids, and communication systems are crucial.

Modern, efficient infrastructure reduces transaction costs, improves connectivity, and attracts foreign direct investment (FDI). Public-private partnerships can be an effective mechanism for financing and managing large-scale infrastructure projects.

Fueling Innovation Through Research and Development

Research and development (R&D) is the engine of technological progress. Governments should incentivize R&D through grants, tax credits, and collaborative initiatives between universities and private sector firms.

Fostering a culture of innovation is paramount. This includes protecting intellectual property rights, promoting entrepreneurship, and creating an environment where risk-taking is encouraged.

The Power of Deregulation

Reducing unnecessary regulatory burdens can unleash entrepreneurial energy and stimulate economic activity.

Streamlining bureaucratic processes, eliminating redundant regulations, and promoting competition can lower costs for businesses and encourage investment. However, deregulation must be approached cautiously, ensuring that essential environmental and consumer protections are maintained.

Tax Incentives: A Catalyst for Investment

Strategic tax incentives can be a powerful tool for encouraging investment in specific sectors or regions. Tax breaks for R&D, investment in renewable energy, or the creation of jobs in economically depressed areas can stimulate economic growth.

However, tax incentives should be carefully designed to avoid distortions and ensure that they provide a genuine benefit to society. Transparency and accountability are essential to prevent abuse and ensure that tax incentives are achieving their intended objectives.

Trade Policies: Opening Doors to Global Markets

Trade policies play a crucial role in shaping a nation’s economic trajectory. Open trade policies, such as free trade agreements (FTAs), can expand market access for domestic businesses, boost exports, and attract FDI.

However, trade policies must also address potential negative consequences, such as job displacement and increased competition from foreign firms. Governments should invest in retraining programs and other support mechanisms to help workers adapt to the changing economic landscape.

Furthermore, promoting fair trade practices and addressing issues such as currency manipulation and intellectual property theft are essential for ensuring a level playing field for domestic businesses.

By implementing a comprehensive and well-designed set of policies, governments and businesses can create an environment conducive to sustained economic growth and improved living standards for all.

LRAS Factors: Your Burning Questions Answered

Here are some common questions about Long-Run Aggregate Supply (LRAS) and its impact on economic growth. We’ll break down the key factors affecting a nation’s potential output.

What exactly does LRAS represent?

LRAS represents the potential output of an economy when all resources are fully employed. It’s a vertical line on a graph, signifying that output is determined by real factors, not price levels.

What are the main determinants of LRAS?

The main determinants of LRAS are the factors that affect an economy’s productive capacity. These include the availability of land, labor, capital, and technology. Improvements in these areas shift the LRAS curve to the right, signifying economic growth.

How does technology impact LRAS?

Technological advancements are a significant driver of LRAS. New technologies increase productivity, allowing businesses to produce more goods and services with the same amount of resources. This leads to higher potential output.

Why is understanding LRAS important for policymakers?

Understanding the determinants of LRAS allows policymakers to focus on policies that promote long-term economic growth. By investing in education, infrastructure, and research and development, governments can shift the LRAS curve to the right and improve living standards.

And that’s the lowdown on LRAS factors! Hopefully, you’ve got a better grasp on what influences the determinants of lras now. Time to put that knowledge to good use!