Government budgets allocate funds across various sectors, impacting society significantly. Congress, through its appropriation process, directly influences discretionary spending government decisions. This spending, unlike mandatory programs such as Social Security, requires annual approval. Analyzing budget reports reveals how resources are allocated, affecting areas from defense to education.

The United States federal budget is a complex web of financial commitments, divided into two primary categories: discretionary spending and mandatory spending. Understanding the distinction between these two is crucial for comprehending how the government allocates resources and influences the nation’s economy.

This section will serve as an introduction to discretionary spending, exploring its definition, significance, and its role within the broader context of the federal budget. We will also briefly touch upon mandatory spending to highlight the key differences between the two.

Defining Discretionary Spending

Discretionary spending refers to the portion of the federal budget that Congress decides on each year through an appropriations process. Unlike mandatory spending, which is determined by existing laws and formulas, discretionary spending is subject to annual review and adjustment.

This means that Congress has the power to increase, decrease, or eliminate funding for various programs and agencies within the discretionary spending framework. These funds are allocated towards a wide range of government activities, from defense and education to scientific research and infrastructure.

The flexibility inherent in discretionary spending makes it a key tool for policymakers to respond to changing priorities, economic conditions, and emerging challenges.

The Significance of Discretionary Spending

While discretionary spending represents a smaller portion of the overall federal budget compared to mandatory spending, its impact on various sectors of the economy and the well-being of citizens is significant.

Impact on Various Sectors

Discretionary funds support essential government functions and services, including:

- National Defense: Funding the military, protecting national security, and maintaining a strong defense posture.

- Education: Investing in schools, universities, and educational programs to foster human capital development and promote lifelong learning.

- Infrastructure: Building and maintaining roads, bridges, and other essential infrastructure to facilitate economic growth and improve quality of life.

- Scientific Research: Supporting research and development in various fields to drive innovation, technological advancement, and economic competitiveness.

- Law Enforcement: Funding law enforcement agencies to maintain public safety, combat crime, and ensure justice.

Impact on the Future

Discretionary spending decisions made today can have far-reaching consequences for the future. Investments in education and infrastructure, for example, can yield long-term benefits in terms of a more skilled workforce and a more robust economy.

Similarly, investments in scientific research can lead to breakthroughs that address pressing global challenges, such as climate change and disease. Understanding the long-term implications of discretionary spending choices is therefore essential for informed policymaking.

Discretionary vs. Mandatory Spending: A Brief Overview

To fully grasp the concept of discretionary spending, it is helpful to distinguish it from mandatory spending. Mandatory spending, also known as entitlement spending, is determined by existing laws and automatically disbursed without annual congressional action.

Major mandatory spending programs include Social Security, Medicare, and Medicaid. These programs provide essential benefits to millions of Americans, and their funding levels are largely driven by demographic trends and eligibility criteria.

The key difference between discretionary and mandatory spending lies in the level of control Congress has over the allocation of funds. While discretionary spending is subject to annual appropriations, mandatory spending is largely predetermined by existing laws.

The flexibility inherent in discretionary spending makes it a key tool for policymakers to respond to changing priorities, economic conditions, and emerging challenges. This flexibility, however, also necessitates careful consideration of its role within the broader framework of fiscal policy.

What is Discretionary Spending? A Detailed Look

Discretionary spending is not simply an isolated budgetary item; it’s an integral component of the government’s overall fiscal policy.

Understanding its function requires a deeper examination of how it interacts with other economic tools and objectives.

Discretionary Spending as a Component of Fiscal Policy

Fiscal policy refers to the government’s use of spending and taxation to influence the economy.

Discretionary spending represents the spending side of this equation, allowing the government to directly inject money into various sectors.

This injection can stimulate economic activity during recessions, fund crucial public services, and invest in long-term growth.

For example, increasing infrastructure spending can create jobs, improve transportation networks, and boost overall productivity.

Conversely, reducing discretionary spending can help control inflation or reduce the national debt, though it may also lead to cuts in essential programs.

Discretionary vs. Mandatory Spending: Key Differences

The distinction between discretionary and mandatory spending is crucial for understanding the federal budget.

Mandatory spending, also known as entitlement spending, is determined by existing laws and formulas.

Social Security and Medicare are prime examples; their funding levels are largely predetermined based on the number of eligible recipients and benefit levels defined by law.

Discretionary spending, on the other hand, is subject to annual appropriations.

Congress decides each year how much to allocate to different discretionary programs.

This difference makes discretionary spending a more flexible tool for responding to immediate needs and changing circumstances, but also makes it subject to political debate and shifting priorities.

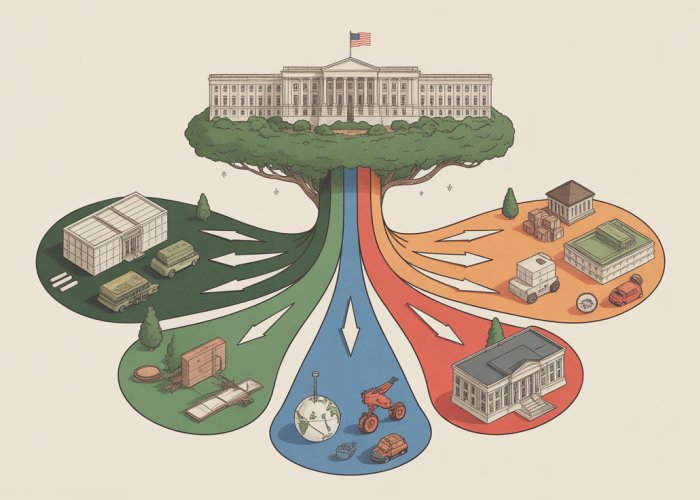

The Role of Congress and the President in Allocation

The allocation of discretionary spending is a complex process involving multiple actors and institutions.

Congress plays a central role through the appropriations process.

The House and Senate Appropriations Committees draft spending bills that outline funding levels for various government agencies and programs.

These bills must then be approved by both chambers of Congress and signed into law by the President.

The President also exerts influence through the budget proposal submitted to Congress each year.

This proposal outlines the President’s priorities and recommends funding levels for various programs.

While Congress is not bound by the President’s budget, it serves as a starting point for negotiations and shapes the broader debate over spending priorities.

Support from the OMB and CBO

The Office of Management and Budget (OMB) and the Congressional Budget Office (CBO) provide crucial support throughout the discretionary spending allocation process.

The OMB, part of the executive branch, assists the President in developing the budget proposal and provides economic forecasts and policy analysis.

The CBO, a nonpartisan agency, provides independent analysis of budgetary and economic issues to Congress.

Its cost estimates and economic projections inform the debate over spending levels and help policymakers assess the potential impact of different budgetary choices.

These organizations ensure that decisions are made on a reliable economic basis.

Discretionary spending, as we’ve seen, offers a flexible mechanism for the government to respond to evolving needs and priorities. But understanding where this money actually goes is crucial to evaluating its effectiveness and impact. Let’s explore the key sectors that rely heavily on discretionary appropriations, examining the specific allocations and their broader consequences.

Key Areas Funded by Discretionary Spending

Discretionary spending fuels a wide array of government functions, but several key areas consistently receive significant portions of the available funds. These include defense, education, and infrastructure, each playing a vital role in national security, human capital development, and economic growth.

Defense Spending

Defense spending invariably constitutes a substantial portion of the discretionary budget. The funds allocated to the Department of Defense (DoD) support military personnel, equipment procurement, research and development, and various operational activities.

Analyzing the allocation of these funds reveals key priorities within the defense establishment. Significant investments are often directed towards advanced technologies, such as artificial intelligence and cybersecurity, reflecting the evolving nature of modern warfare.

The impact of defense spending extends beyond national security. It creates jobs within the defense industry, stimulates technological innovation, and influences geopolitical dynamics.

However, it also raises critical questions about resource allocation, the opportunity cost of investing in military solutions versus social programs, and the potential for unintended consequences in international relations.

Education Spending

Investment in education, primarily through the Department of Education, represents another crucial area of discretionary spending. These funds support a wide range of programs, including grants for primary and secondary education, financial aid for higher education, and initiatives aimed at improving educational outcomes for disadvantaged students.

The influence of education spending on human capital development is undeniable. By investing in education, the government aims to equip citizens with the knowledge and skills necessary to succeed in the modern economy, fostering innovation, productivity, and social mobility.

However, the effectiveness of education spending is often debated. Questions arise about the optimal allocation of resources, the role of federal intervention in local education systems, and the need for accountability in achieving desired outcomes.

Moreover, the long-term impact of education spending extends to broader societal benefits, such as reduced crime rates, improved public health, and increased civic engagement. These positive externalities underscore the importance of continued investment in education.

Infrastructure

Government spending on infrastructure projects represents a critical component of discretionary spending, with funding allocated to transportation, energy, water, and communication systems. These investments are essential for maintaining and upgrading the nation’s physical infrastructure, supporting economic activity, and improving quality of life.

The role of infrastructure in fostering economic growth is well-documented. Efficient transportation networks facilitate trade and commerce, reliable energy systems power industries, and modern communication systems enable innovation and collaboration.

Furthermore, infrastructure projects create jobs in the construction and engineering sectors, stimulating economic activity and providing opportunities for skilled workers.

However, infrastructure investments often involve complex planning processes, lengthy permitting procedures, and significant financial commitments.

Prioritizing infrastructure projects requires careful consideration of economic benefits, environmental impacts, and social equity considerations.

The long-term effects of infrastructure investments extend beyond economic growth, contributing to improved public health, reduced traffic congestion, and enhanced environmental sustainability.

Discretionary spending, as we’ve seen, offers a flexible mechanism for the government to respond to evolving needs and priorities. But understanding where this money actually goes is crucial to evaluating its effectiveness and impact. Let’s explore the key sectors that rely heavily on discretionary appropriations, examining the specific allocations and their broader consequences.

The Discretionary Spending Allocation Process: How Decisions Are Made

The allocation of discretionary spending is a complex process, deeply intertwined with the political and economic landscape. It is not merely a technical exercise; it reflects the nation’s values, priorities, and the ongoing negotiation between competing interests. Understanding this process is essential to comprehending how government resources are ultimately distributed.

The Congressional Budgeting Process: Setting the Stage

The budgeting process begins well in advance of the fiscal year, with the President submitting a budget proposal to Congress. This proposal outlines the President’s spending priorities and serves as a starting point for congressional deliberations.

However, Congress, not the President, holds the power of the purse.

The House and Senate Budget Committees then craft their own budget resolutions, which set overall spending targets for discretionary and mandatory spending. These resolutions are non-binding but provide a framework for the Appropriations Committees.

Reaching a consensus on these resolutions can be a major hurdle, particularly when the House and Senate are controlled by different parties or when there are deep divisions within a single party.

Once a budget resolution is adopted (or even without one, through a process called "deeming resolution"), the Appropriations Committees begin their work.

The Role of the Appropriations Committees: Dividing the Pie

The Appropriations Committees in both the House and Senate are responsible for allocating discretionary spending to specific federal departments, agencies, and programs.

Each committee has twelve subcommittees, each focusing on a different area of the budget, such as defense, education, or transportation.

These subcommittees hold hearings, review budget requests from agencies, and draft appropriations bills that specify how much money each program will receive.

This is where the real nitty-gritty decisions are made, often involving intense lobbying from various interest groups and agencies.

The appropriations bills must then pass both the House and the Senate and be signed into law by the President.

If Congress fails to pass all appropriations bills by the start of the fiscal year (October 1st), it must pass a continuing resolution to temporarily extend funding at existing levels to avoid a government shutdown.

Influential Voices: OMB and CBO

Two key agencies play a significant role in shaping budgetary decisions: the Office of Management and Budget (OMB) and the Congressional Budget Office (CBO).

The OMB, part of the executive branch, assists the President in preparing the budget and oversees the implementation of the enacted budget.

The CBO, a nonpartisan agency, provides Congress with independent analyses of budgetary and economic issues.

The CBO’s cost estimates of proposed legislation are particularly influential, as they help lawmakers understand the potential financial impact of their decisions.

Both the OMB and the CBO use sophisticated economic models and analytical tools to project future spending and revenue, informing the debate over fiscal policy.

However, it’s essential to remember that these are projections, not predictions, and are subject to uncertainty and changing economic conditions.

The discretionary spending allocation process is a multifaceted interplay of political negotiation, economic analysis, and competing priorities. Understanding the roles of Congress, the Appropriations Committees, the OMB, and the CBO is crucial to grasping how these vital decisions are made and their subsequent impact on the nation.

Discretionary spending, as we’ve seen, offers a flexible mechanism for the government to respond to evolving needs and priorities. But understanding where this money actually goes is crucial to evaluating its effectiveness and impact. Let’s explore the key sectors that rely heavily on discretionary appropriations, examining the specific allocations and their broader consequences.

The Wide-Ranging Impact of Discretionary Spending

Discretionary spending acts as a powerful lever, influencing everything from the pace of economic growth to the well-being of citizens and the trajectory of crucial industries. The choices made during the allocation process reverberate throughout society, creating both opportunities and potential pitfalls. Understanding these effects is crucial for informed civic engagement.

Economic Growth and Job Creation

Government investment through discretionary spending can act as a catalyst for economic expansion. Allocations to infrastructure projects, for example, directly create jobs in construction and related industries. Furthermore, these projects enhance the nation’s infrastructure, improving efficiency and productivity, indirectly supporting additional businesses.

Similarly, investments in research and development can spur innovation, leading to new industries and employment opportunities. The ripple effect of these investments can be substantial, boosting overall economic activity.

Conversely, reductions in discretionary spending can have a contractionary effect, leading to job losses and slower economic growth. Careful consideration of the potential economic consequences is essential when making budgetary decisions.

Social Welfare and the Safety Net

Beyond economic considerations, discretionary spending plays a critical role in supporting social welfare programs and maintaining the nation’s safety net. Funding for programs like housing assistance, food assistance, and job training directly impacts the lives of vulnerable populations.

These programs provide crucial support during times of economic hardship, helping to prevent poverty and promote social stability. Underfunding these programs can have devastating consequences, exacerbating inequality and creating hardship for those who are most in need.

The long-term societal costs associated with inadequate social safety nets often outweigh any short-term budgetary savings. A balanced approach that prioritizes both economic growth and social well-being is crucial.

Shaping Key Sectors: Defense, Education, and Infrastructure

Discretionary spending decisions have a profound impact on the future of key sectors like defense, education, and infrastructure. The level of investment in these areas shapes their capacity to meet future challenges and contribute to national prosperity.

Defense Spending and National Security

Defense spending is a significant component of discretionary spending. Allocations to the Department of Defense determine the nation’s ability to maintain a strong military, deter threats, and protect its interests abroad.

The decisions regarding defense spending are complex, involving considerations of national security, technological innovation, and geopolitical strategy. Striking the right balance between these competing factors is essential for ensuring both national security and fiscal responsibility.

Education Spending and Human Capital Development

Investment in education is critical for developing human capital and ensuring a competitive workforce. Discretionary spending on education supports programs ranging from early childhood education to higher education.

These investments enhance the skills and knowledge of the population, leading to increased productivity, innovation, and economic growth. A well-educated workforce is essential for competing in the global economy and addressing the challenges of the future.

The Long-Term Impact of Education Spending

The benefits of education spending extend far beyond the immediate economic impact. Education empowers individuals, promotes social mobility, and strengthens democratic institutions.

A society that invests in education is more likely to be innovative, adaptable, and resilient. The long-term societal benefits of education far outweigh the costs.

Infrastructure Investment and Economic Competitiveness

Modern and reliable infrastructure is essential for economic competitiveness and quality of life. Discretionary spending on infrastructure supports the construction and maintenance of roads, bridges, airports, and other essential facilities.

These investments improve transportation efficiency, reduce congestion, and facilitate trade. A well-maintained infrastructure is essential for attracting businesses, creating jobs, and supporting economic growth.

Discretionary spending, as we’ve seen, offers a flexible mechanism for the government to respond to evolving needs and priorities. But understanding where this money actually goes is crucial to evaluating its effectiveness and impact. Let’s explore the key sectors that rely heavily on discretionary appropriations, examining the specific allocations and their broader consequences.

Challenges and Considerations in Discretionary Spending

Discretionary spending is not without its complexities. Allocating these funds involves navigating a landscape of competing interests, economic uncertainties, and political pressures. These factors create significant challenges for policymakers as they strive to balance immediate needs with long-term fiscal stability.

Political and Economic Obstacles

The political arena injects a layer of complexity into discretionary spending decisions. Different political parties often hold vastly different views on the appropriate levels of spending for various sectors.

For example, one party might prioritize defense spending, while another emphasizes social programs or environmental protection.

These differing priorities can lead to gridlock and protracted negotiations, making it difficult to reach consensus on budget allocations.

Economic conditions also play a significant role. During periods of economic recession, there may be increased pressure to boost discretionary spending to stimulate the economy through job creation and infrastructure development.

However, this must be balanced against concerns about increasing the national debt.

Conversely, during periods of economic expansion, there may be calls for fiscal restraint and reduced discretionary spending to prevent inflation.

These competing pressures create a challenging environment for policymakers, who must carefully weigh the economic realities with political considerations.

Trade-Offs and Fiscal Responsibility

Discretionary spending decisions inevitably involve trade-offs. Allocating more funds to one sector often means reducing funding for another. This necessitates a careful evaluation of priorities and a willingness to make difficult choices.

For instance, increasing investment in education might require cuts to other programs, such as transportation or housing. These decisions can have significant consequences for different segments of society.

Moreover, the need for fiscal responsibility adds another layer of complexity. Policymakers must consider the long-term implications of their spending decisions on the national debt and future generations.

Excessive discretionary spending can lead to unsustainable levels of debt, which can have negative consequences for economic growth and stability.

Therefore, it is essential to strike a balance between addressing immediate needs and ensuring long-term fiscal sustainability.

Fiscal Policy Challenges

The government budget can be significantly impacted by fiscal policy decisions related to discretionary spending. Expansionary fiscal policy, characterized by increased government spending and tax cuts, can lead to a larger budget deficit and increased national debt.

While this may stimulate economic growth in the short term, it can also lead to inflation and higher interest rates in the long run.

Conversely, contractionary fiscal policy, characterized by reduced government spending and tax increases, can help to reduce the budget deficit and national debt.

However, it can also lead to slower economic growth and increased unemployment.

The challenge lies in finding the right balance between fiscal stimulus and fiscal restraint, ensuring that discretionary spending decisions are aligned with broader economic goals and do not jeopardize long-term fiscal stability.

Discretionary Spending: Frequently Asked Questions

What exactly is discretionary spending?

Discretionary spending refers to the portion of your income you have left over after covering essential needs like rent, utilities, and groceries. It’s the money you can choose to spend on things like entertainment, travel, or eating out. Consider how even discretionary spending government allocations can impact your personal finances.

How does my discretionary spending affect my future?

The choices you make about discretionary spending today can have a significant impact on your future financial well-being. Saving and investing even a small portion of your discretionary income over time can compound and grow into a substantial nest egg. Poor choices can lead to debt.

What are some examples of discretionary spending traps to avoid?

Watch out for lifestyle creep – gradually increasing your discretionary spending as your income rises. Also, avoid impulse purchases and unnecessary subscriptions. Being mindful of these traps can help you maintain control over your finances. The discretionary spending government often has to make is a reminder that spending choices always have consequences.

How can I better manage my discretionary spending?

Start by tracking where your money goes to identify areas where you can cut back. Create a budget and allocate specific amounts for different discretionary categories. Consider setting up automatic transfers to a savings or investment account to "pay yourself first."

So, there you have it – a glimpse into how discretionary spending government works and its impact on all of us! We hope this helps you understand the topic better. See you around!